Introduction

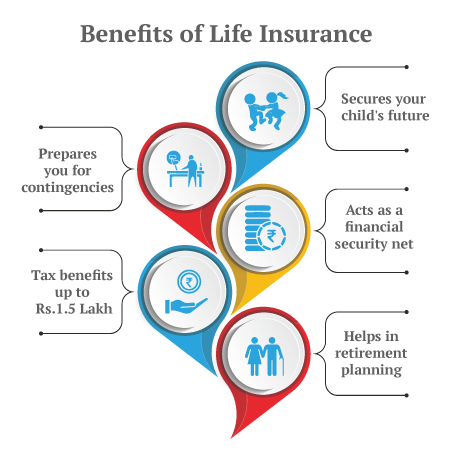

As we age, planning for the future becomes increasingly important. One crucial aspect of this planning is life insurance, especially for seniors. Life insurance for seniors not only provides financial security for loved ones but also offers peace of mind during one’s later years. In this comprehensive guide, we’ll explore the various types of life insurance available to seniors, factors influencing premiums, and tips for choosing the right policy.

Understanding Life Insurance for Seniors:

What is Life Insurance for Seniors?

Life insurance for seniors is a policy designed to provide financial support to beneficiaries after the policyholder’s death. These policies are tailored to meet the unique needs of older adults, considering factors like age, health, and financial goals.

Why is it Important?

As a senior, life insurance can help cover final expenses, pay off debts, and leave a legacy for loved ones. It ensures that your family isn’t burdened with financial obligations during an already challenging time.

Types of Life Insurance Policies for Seniors:

1. Term Life Insurance

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. It’s often more affordable and straightforward, making it a popular choice for seniors looking to cover specific financial obligations.

2. Whole Life Insurance

Whole life insurance offers lifelong coverage with a cash value component that grows over time. While premiums are higher, this policy can serve as an investment and provide financial security for beneficiaries.

3. Universal Life Insurance

Universal life insurance combines flexible premiums with a cash value component. It allows policyholders to adjust their coverage and premiums, providing adaptability to changing financial situations.

4. Guaranteed Issue Life Insurance

Guaranteed issue life insurance doesn’t require a medical exam, making it accessible for seniors with health issues. However, it often comes with higher premiums and limited coverage amounts.

5. Burial or Final Expense Insurance

This type of whole life insurance is designed to cover funeral and burial expenses. It ensures that your family isn’t left with the financial burden of these costs.

Factors Influencing Life Insurance Premiums for Seniors:

Age

As you age, life insurance premiums typically increase. This is because the risk to the insurer rises with age.

Health

Your overall health plays a significant role in determining premiums. Seniors in good health may qualify for lower rates, while those with chronic conditions might face higher premiums or limited options.

Lifestyle Choices

Habits like smoking can increase premiums. Conversely, maintaining a healthy lifestyle can help reduce costs.

Coverage Amount

The higher the death benefit, the higher the premium. It’s essential to choose a coverage amount that aligns with your financial goals and obligations.

Choosing the Right Life Insurance Policy:

Assess Your Needs

Determine what you want your life insurance to accomplish. Is it to cover funeral expenses, pay off debts, or leave a legacy? Understanding your objectives will guide your decision.

Compare Policies

Don’t settle for the first policy you come across. Compare different types of insurance, coverage amounts, and premiums to find the best fit for your needs.

Consult with an Expert

Consider speaking with a financial advisor or insurance expert. They can provide personalized advice and help you navigate the complexities of life insurance.

Common Mistakes to Avoid:

Overestimating Coverage Needs

While it’s essential to have adequate coverage, overestimating your needs can lead to unnecessarily high premiums. Be realistic about your financial obligations and goals.

Ignoring Policy Terms

Always read the fine print. Understanding the terms, exclusions, and conditions of your policy can prevent unpleasant surprises later.

Neglecting Beneficiary Updates

Life circumstances change. Ensure that your beneficiaries are up-to-date to avoid complications during claims.

Real-Life Scenarios:

Scenario 1: Covering Final Expenses

John, a 72-year-old retiree, purchases a burial insurance policy to cover his funeral expenses. This ensures that his family isn’t burdened with these costs during a difficult time.

Scenario 2: Leaving a Legacy

Mary, a grandmother, buys a whole life insurance policy with the intent to leave a financial gift for her grandchildren’s education. This allows her to contribute to their futures even after she’s gone.

Tips for Seniors Considering Life Insurance:

- Start Early: The earlier you purchase life insurance, the more affordable it tends to be.

- Maintain a Healthy Lifestyle: Regular exercise and a balanced diet can improve your health and potentially lower premiums.

- Review Your Policy Regularly: Life changes, and so should your insurance coverage. Regular reviews ensure your policy meets your current needs.

Conclusion:

Life insurance for seniors is a vital component of financial planning. By understanding the different types of policies, factors influencing premiums, and common pitfalls, seniors can make informed decisions that provide financial security for themselves and their loved ones. Remember, the right life insurance policy can offer peace of mind, knowing that you’ve taken steps to protect your family’s future.