How Does Health Insurance Work? A Simple Guide for 2024

Introduction:

Health insurance can feel like reading a foreign language – deductibles, copays, networks – what does it all mean? If you’ve ever wondered how does health insurance work, you’re not alone. This guide will break down the confusing world of health coverage into simple, easy-to-understand pieces. We’ll cover everything from basic terms to insider tips for getting the most from your plan. Whether you’re choosing your first policy or just trying to understand your current one better, this guide will give you the knowledge you need to make smart healthcare decisions. Let’s decode health insurance together!

The Basics of Health Insurance:

Health insurance is essentially a deal between you and an insurance company. You pay them money (premiums), and they help cover your medical costs. Think of it like a gym membership – you pay monthly to have access to services when you need them.

Key things to know:

- Insurance helps protect you from crazy-high medical bills

- Different plans cover different services

- You’ll usually pay part of the costs (that’s your share)

- The insurance company pays the rest (that’s their share)

It’s not free healthcare, but it makes healthcare costs more predictable and manageable.

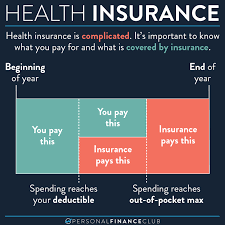

Key Health Insurance Terms Explained:

Let’s translate those confusing insurance words:

- Premium: Your monthly bill to keep insurance active

- Deductible: What you pay before insurance kicks in

- Copay: Fixed fee for services ($20 doctor visits)

- Coinsurance: Your percentage share of costs (you pay 20%)

- Out-of-pocket maximum: Most you’ll pay in a year

- Network: Doctors/hospitals that accept your insurance

- Formulary: List of covered prescription drugs

Pro tip: Lower premiums often mean higher deductibles, and vice versa. There’s always a trade-off.

Types of Health Insurance Plans:

Not all health insurance works the same. Here are the main types:

- HMO (Health Maintenance Organization):

- Lower costs

- Must use network doctors

- Need referrals for specialists

- PPO (Preferred Provider Organization):

- More provider choices

- Can see specialists without referrals

- Higher premiums but more flexibility

- EPO (Exclusive Provider Organization):

- Mix of HMO and PPO features

- No out-of-network coverage

- Usually no referrals needed

- HDHP (High Deductible Health Plan):

- Lower premiums

- Higher deductibles

- Often paired with HSAs

- POS (Point of Service):

- Need primary care referrals

- Some out-of-network coverage

- Middle-ground option

Each type has pros and cons depending on your health needs and budget.

How Health Insurance Pays for Care:

Here’s the typical process when you need medical care:

- You visit a doctor or hospital

- They check your insurance coverage

- You pay any required copay upfront

- Provider bills your insurance

- Insurance processes the claim

- You get an Explanation of Benefits (EOB)

- You may owe more if deductible isn’t met

Important notes:

- Always check if providers are in-network

- Some services require pre-authorization

- Mistakes happen – review all medical bills

What Health Insurance Covers (And Doesn’t):

Most plans cover:

✔ Doctor visits

✔ Hospital stays

✔ Emergency care

✔ Preventive services

✔ Prescription drugs

✔ Pregnancy/newborn care

✔ Mental health services

Common exclusions:

✖ Cosmetic procedures

✖ Weight loss surgery

✖ Experimental treatments

✖ Dental/vision (usually separate)

✖ Long-term care

Always check your specific plan details – coverage varies widely.

How to Get Health Insurance:

You have several options:

- Employer-Sponsored:

- Through your job

- Often most affordable

- Limited choice of plans

- Marketplace (ACA):

- Healthcare.gov or state exchanges

- Income-based subsidies available

- Open enrollment periods apply

- Private Insurance:

- Directly from insurers

- More plan choices

- No income restrictions

- Government Programs:

- Medicare (65+ or disabled)

- Medicaid (low income)

- CHIP (children’s health)

- Short-Term Plans:

- Temporary coverage

- Less comprehensive

- Doesn’t meet ACA requirements

5 Ways to Save on Health Insurance:

Health coverage doesn’t have to break the bank:

- Shop Around Annually:

- Compare plans each year

- Needs and options change

- Use Preventive Care:

- Free annual checkups

- Catches problems early

- Choose Generic Drugs:

- Same effectiveness

- Much lower cost

- Consider Telehealth:

- Virtual visits often cheaper

- Great for minor issues

- Health Savings Accounts:

- Tax-free medical savings

- Only with HDHPs

Common Health Insurance Mistakes:

Avoid these costly errors:

- Not checking if providers are in-network

- Skipping preventive care to save money

- Assuming all “covered” services are free

- Not appealing denied claims

- Forgetting to update personal information

FAQs About Health Insurance:

Q: Can I keep my current doctor?

A: Only if they’re in your plan’s network. Always verify first.

Q: What if I can’t afford insurance?

A: You may qualify for Medicaid or Marketplace subsidies.

Q: Are pre-existing conditions covered?

A: Yes, under ACA-compliant plans.

Q: Can I get insurance outside Open Enrollment?

A: Only with qualifying life events like marriage or job loss.

Q: What’s better – low premium or low deductible?

A: Depends on your expected healthcare needs.

Conclusion:

Understanding how health insurance works puts you in control of your healthcare decisions. While the system can be complex, knowing the basics helps you choose the right plan and use it effectively. Remember to review your coverage annually, ask questions when unsure, and take advantage of preventive services. Your health is your most valuable asset – make sure it’s properly protected!

Next Steps:

- Review your current plan details

- List your healthcare priorities

- Compare options during next enrollment

- Consult a broker if needed

With this knowledge, you’re ready to navigate health insurance like a pro!