New Health Insurance in 2025: A Revolution in Care and Coverage

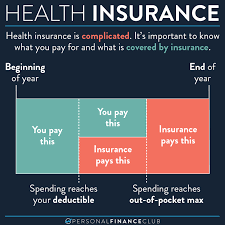

Health insurance is undergoing a profound transformation in 2025. As the world faces rising healthcare costs, evolving health threats, and technological disruptions, new health insurance models are emerging that prioritize prevention, personalization, and accessibility.

Today’s health insurance is no longer just about covering medical bills when you get sick. It has become a proactive, tech-enabled partner in your health journey, helping you stay healthy, detect risks early, and manage chronic conditions effectively while ensuring financial protection when medical care is needed.

Why Health Insurance Needed to Change

The past decade has shown us the vulnerabilities in healthcare systems worldwide. Factors driving the change include:

-

Rising chronic illnesses due to lifestyle factors.

-

Mental health crises increasing the need for comprehensive care.

-

Climate-related health issues, including heat stress and respiratory problems.

-

Global pandemics, emphasizing the need for swift healthcare access.

-

Consumer demand for digital, seamless experiences over complex paperwork.

In response, health insurers in 2025 have shifted from reactive reimbursement models to active partners in preventive healthcare, wellness, and patient-centered services.

Key Trends in Health Insurance 2025

1️⃣ Preventive and Wellness-Focused Coverage

In 2025, health insurance policies actively encourage wellness by offering premium discounts and rewards for maintaining healthy habits. Insurers use data from fitness trackers, smartwatches, and health apps to monitor activity, sleep, and diet, rewarding customers who achieve health goals.

Preventive care benefits now include annual screenings, mental health check-ins, and personalized diet plans to detect issues early, reducing the need for expensive treatments later.

2️⃣ Telemedicine and Virtual Health Integration

The pandemic accelerated telemedicine adoption, and in 2025, virtual consultations are a core feature of health insurance plans. Policyholders can schedule virtual appointments with doctors, mental health professionals, and nutritionists, ensuring timely medical care without the hassle of travel or waiting rooms.

Some insurers also provide AI-powered symptom checkers and remote monitoring for chronic conditions, enabling continuous care while reducing hospital admissions.

3️⃣ Mental Health is Mainstream

Mental health coverage is no longer an add-on; it is central to health insurance in 2025. Plans now include therapy sessions, online counseling, mindfulness programs, and psychiatric support, recognizing the link between mental and physical well-being.

Many insurers provide access to mental health apps and platforms, offering guided meditation, stress management, and cognitive behavioral therapy (CBT) support, often at no additional cost.

4️⃣ Personalized Policies with Dynamic Premiums

Health insurance in 2025 is highly personalized. Using AI and health data analytics, insurers can create tailored policies aligned with your health risks and lifestyle. Dynamic premiums adjust based on lifestyle changes, incentivizing healthy behavior while providing fair pricing.

For example, if you stop smoking or reach your weight loss goal, your premiums may decrease, reflecting your reduced health risk.

5️⃣ Integration with Wearables and Health Devices

Smart devices now seamlessly connect with insurers, sharing real-time health data (with user consent) to monitor wellness, detect anomalies, and provide early interventions. If your wearable detects irregular heartbeats, your insurer can prompt a teleconsultation, reducing potential severe complications.

New Products in Health Insurance 2025

🌱 Micro Health Insurance for Daily Workers

Gig workers and daily wage earners often lack coverage due to affordability issues. In 2025, micro health insurance products offer low-cost, on-demand health coverage, allowing workers to pay small premiums for daily or weekly protection.

🩺 Chronic Care Management Plans

Insurers now offer dedicated plans for chronic conditions like diabetes, hypertension, and asthma, bundling medical consultations, medication delivery, dietary support, and regular monitoring to ensure adherence and reduce hospitalizations.

🧠 Mental Wellness Riders

Optional mental health riders allow customers to add extra therapy sessions, rehabilitation, and digital mental health platform access to their plans at a low additional cost.

🌍 Climate Health Cover

With climate-related illnesses on the rise, insurers now provide coverage for heat-related illnesses, respiratory conditions from pollution, and vector-borne diseases under climate health riders, recognizing the health impacts of environmental changes.

The Role of Technology in New Health Insurance

Health insurance in 2025 is powered by AI, blockchain, and predictive analytics:

-

AI helps in underwriting policies more accurately, enabling fair pricing based on health profiles.

-

Blockchain ensures secure and transparent claims processes, reducing fraud and delays.

-

Predictive analytics uses your health data to identify potential risks early, offering proactive health advice and interventions.

-

Mobile apps serve as a one-stop solution for policy management, teleconsultation, wellness tracking, and claims filing, making insurance user-friendly.

How Claims Have Changed in 2025

One of the biggest pain points in traditional health insurance was claims processing. In 2025:

✅ Cashless treatment networks have expanded, including hospitals, clinics, pharmacies, and labs.

✅ Instant claims processing using AI reduces paperwork and approval times.

✅ Smart contracts on blockchain enable automatic claims payouts when treatment is completed and verified.

✅ Virtual claims assistance through chatbots guides customers through the process step-by-step.

Challenges in Health Insurance 2025

Despite remarkable progress, challenges remain:

-

Data privacy concerns as insurers collect sensitive health data.

-

Digital divide limiting access for those without smartphones or internet connectivity.

-

Regulatory frameworks need continuous evolution to handle tech-enabled insurance.

-

Balancing personalization with affordability, ensuring premiums remain fair.

Insurers are addressing these challenges with transparent data policies, community outreach programs for digital education, and partnerships with regulators to ensure customer protection.

The Human Element in Health Insurance

Technology has improved convenience, but health is deeply personal. In 2025, leading insurers combine technology with human-centered support:

-

Health coaches and care managers assist patients in navigating treatments.

-

Emotional support is provided during critical illnesses and recovery.

-

Local partnerships ensure in-person care when needed.

Preparing for Your Health Insurance in 2025

If you want to make the most of new health insurance offerings this year:

✅ Review your current plan: Check if it includes telemedicine, mental health support, and preventive care benefits.

✅ Use wearable integrations if your insurer offers rewards for healthy habits.

✅ Explore personalized policies that match your lifestyle and health needs.

✅ Check for chronic care plans if you or a family member has ongoing health conditions.

✅ Stay informed about privacy policies regarding your health data.

Conclusion: A Healthier, More Empowered You

Health insurance in 2025 is more than just protection; it is a partner in your well-being. With personalized coverage, preventive care incentives, and digital-first experiences, insurers aim to empower you to live a healthier, more confident life.

By embracing these new models, you can protect your finances while prioritizing your physical and mental well-being, ensuring that health insurance is not just something you pay for, but something that actively adds value to your life every day.

This given information is taken from Chatgpt.