1. Introduction:

In an era marked by uncertainties, insurance emerges as a cornerstone of financial planning. It offers a safety net against unforeseen events, ensuring that individuals and families can navigate challenges without debilitating financial strain. From health emergencies to property damage, insurance provides a structured mechanism to manage risks and secure financial well-being.

2. Financial Security and Risk Mitigation:

One of the primary benefits of insurance is the financial security it offers. Unexpected events such as accidents, illnesses, or natural disasters can lead to significant financial setbacks. Insurance policies are designed to mitigate these risks by providing financial support when it’s needed most. This support ensures that individuals do not have to bear the full brunt of unexpected expenses, preserving their financial stability.

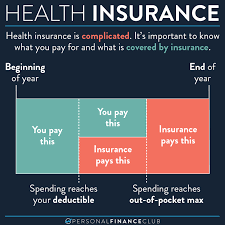

3. Access to Quality Healthcare:

Health insurance plays a pivotal role in ensuring access to quality medical care. With comprehensive health coverage, individuals can seek treatment from reputable hospitals and healthcare providers without the constant worry of high medical costs. Moreover, health insurance often includes coverage for preventive services such as regular check-ups, vaccinations, and screenings, promoting early detection and management of health issues. This proactive approach to health can lead to better health outcomes and a higher quality of life.

4. Protection of Assets:

Insurance serves as a safeguard for your assets, including your home, vehicle, and personal belongings. For instance, homeowners insurance can cover expenses related to repairing or replacing your home in the event of natural disasters or accidents. Similarly, auto insurance assists with the costs of vehicle repairs or replacement following accidents or theft. This protection ensures that your valuable assets are shielded from unforeseen events, preserving your financial well-being.

5. Liability Coverage:

Liability insurance provides protection against legal claims and lawsuits, particularly in situations where others sustain injuries or property damage due to your actions or negligence. For example, if someone is injured on your property, liability coverage can help cover legal fees and potential settlements. This type of insurance is crucial for mitigating the financial risks associated with legal liabilities, ensuring that you are not financially burdened by unforeseen legal expenses.

6. Business Continuity Assurance:

For business owners, insurance is essential in ensuring the continuity and stability of operations. Business insurance policies can cover losses resulting from events such as theft, natural disasters, or equipment failure. Additionally, certain policies offer protection against business interruptions, helping to maintain operations during unforeseen disruptions. This assurance allows business owners to focus on growth and development without the constant worry of potential setbacks.

7. Peace of Mind:

Having insurance provides a profound sense of peace, knowing that you are financially protected against life’s uncertainties. This peace of mind allows you to focus on other aspects of life without the constant worry of potential financial hardships resulting from unforeseen events. It alleviates stress and anxiety, contributing to overall well-being and a more balanced lifestyle.

8. Encouragement of Savings and Investment:

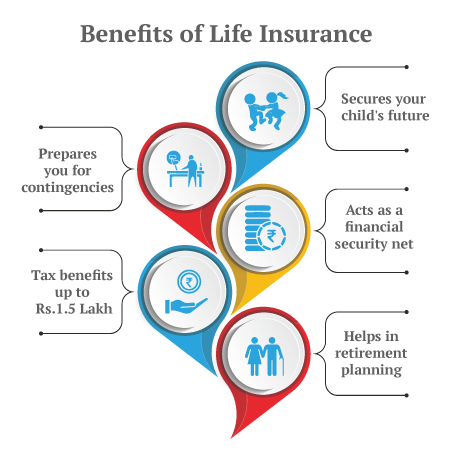

Certain types of insurance policies, such as whole life or endowment plans, offer both protection and investment opportunities. A portion of the premium paid is allocated towards investment, allowing the policy to accumulate cash value over time. This feature encourages disciplined saving and investment, contributing to long-term financial goals such as purchasing a home, funding education, or securing a comfortable retirement.

9. Tax Benefits:

Insurance policies often come with tax advantages, providing individuals with opportunities to reduce their taxable income. For instance, in many jurisdictions, premiums paid towards life insurance and health insurance are eligible for tax deductions. Additionally, the maturity benefits or payouts received from certain insurance policies may be tax-free, enhancing the overall financial efficiency of investing in insurance. These tax benefits can lead to substantial savings, improving your financial position.

10. Legal Compliance:

In many regions, certain types of insurance are legally mandated. For example, automobile insurance is compulsory in numerous countries to ensure that drivers can cover costs associated with accidents or damages. Similarly, businesses may be required to carry liability insurance to operate legally. Adhering to these legal requirements not only ensures compliance but also protects against potential legal repercussions and financial penalties.

Conclusion:

Incorporating insurance into your financial strategy is a prudent step toward safeguarding your future and achieving peace of mind. It offers a multifaceted safety net, protecting against unforeseen events, promoting access to quality healthcare, preserving assets, and providing financial incentives such as tax benefits and investment opportunities. By understanding and leveraging the diverse advantages of insurance, you can navigate life’s uncertainties